E E L

CONSULTING

Enterprise Risk ∙ Crisis Planning ∙ Cyber Risk

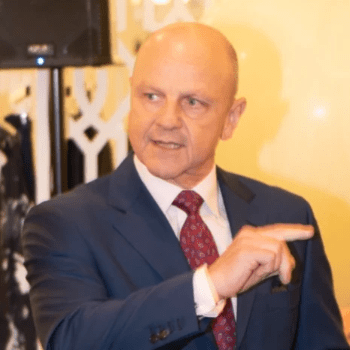

HUGH

FERRIDGE

A Royal Air Force veteran with experience working with the NATO alliance and in Northern Ireland. My background in Special Investigations and Counter Intelligence has proved equally relevant to the (slightly less dangerous!) world of commercial risk.

PROJECTS

A selection of engagements

Selfridges&Co

International Retail

- Global business continuity planning

- Implementing XBR fraud data mining capability

- Risk policies including 'whistle-blowing', fraud & bribery

Burberry

Global Brand

- Securing international distribution centres

- Defining global loss prevention strategies

- Business continuity and crisis planning

International Not-for-Profit

Washington DC Not-for-Profit

- Enterprise risk strategy and policies

- Crisis management and disaster recovery processes

- Cyber risk and PCI compliance policies

CONTACT

1100 Connecticut Ave NW, Washington, District of Columbia 20036, US301-830-2488SERVICES

Enterprise Risk ∙ Crisis Planning ∙ Cyber Risk ∙ Payment Risk

ENTERPRISE RISK

Managing risk is a strategic objective

Managing risk across an enterprise should be seen as relevant and integral to a company’s strategic objectives - not relegated to the 'too hard' category. Risk is an integral part of every business activity. With strategic risk insights, rigorous analytics and deep industry experience, companies can achieve pragmatic solutions that manage risk and achieve profitable growth.

CRISIS PLANNING

Reputations can be made or broken by your first response.

As Warren Buffett said, it takes 20 years to build a reputation and five minutes to ruin it. Without pro-active strategies, an uncoordinated initial response to a crisis may have unforeseen effects on your business and your reputation. An effective crisis management plan helps companies respond more effectively, more quickly and ensures that everyone from reception to the CEO's office understands the roles they need to play - now and throughout the crisis.

CYBER RISK

What to do when one click can spell disaster.

Everyone has heard about cyber risk, not many understand it, but it has to be part of your corporate culture. Just about everything we do is managed, created or facilitated by technology - and yet one wrong click can spell disaster! We look at cyber risk and responses across the enterprise - from education appropriate to different roles to customer and regulatory communications; from disaster readiness protocols to simply knowing where and how your critical data is stored. This is one area where pro-active planning can literally save your company.

PAYMENT RISK

Protecting your Procure-to-Pay business cycle

Almost every organization loses valuable funds and working capital via payments made in error - both accidental and due to deliberate fraud.

EEL Consulting is working closely with Fiscal Technologies Inc to provide a leading payment protection service - NXG Forensics®. NXG is cloud based, secure and scalable and crucially flags high-risk transactions before payment. Data from any ERP system is received and processed automatically, presenting your Accounts Payable team with prioritized risk alerts, giving them time to approve payments or hold back for root-cause analysis.

P2P Transactional Risk

Stop high-risk payments

Identify areas of risk and fraud within vendor spend and transactions

Vendor Risk Profiling

Reduce Vendor Errors

Discover vendor risk through continuous profiling

Anti-Fraud Controls

Reduce Vendor Fraud

Automated testing to identify fraudulent transactions and vendors

Reporting & Dashboards

Actionable Insights

Unlocking actionable insights to drive process improvement